capital gains tax increase date

Currently the capital gains rate is 20 for. Additionally there are four tax rates for estates and.

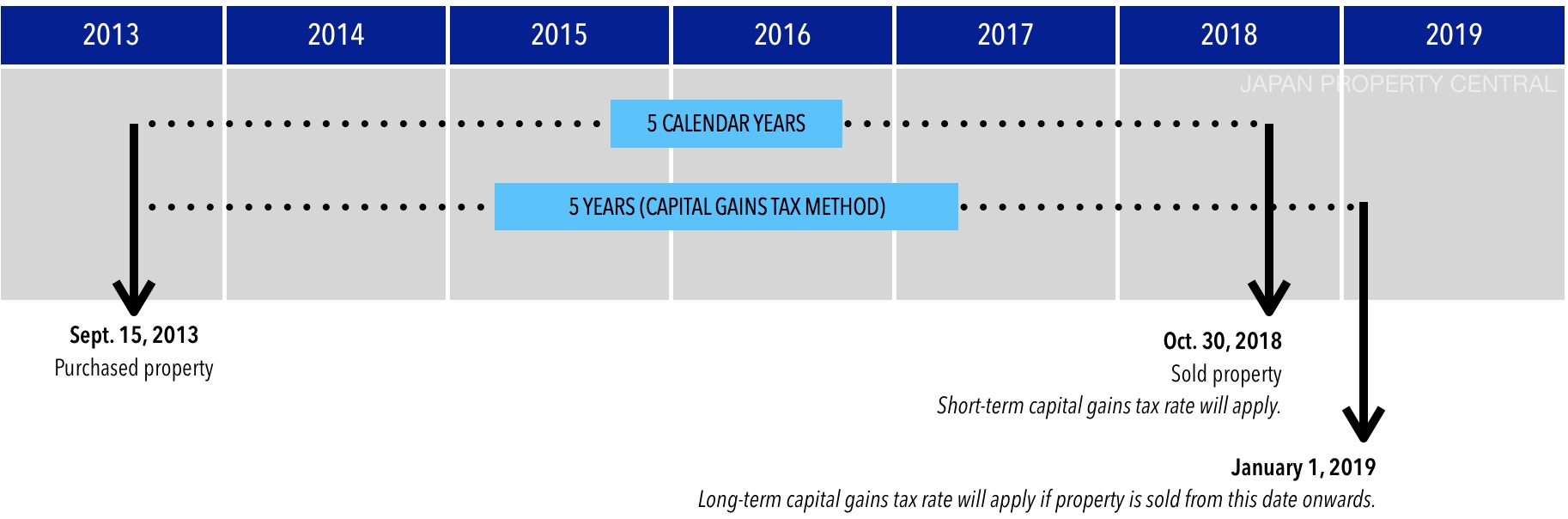

Capital Gains Tax Japan Property Central

Short-term capital gains come from assets held for under a year.

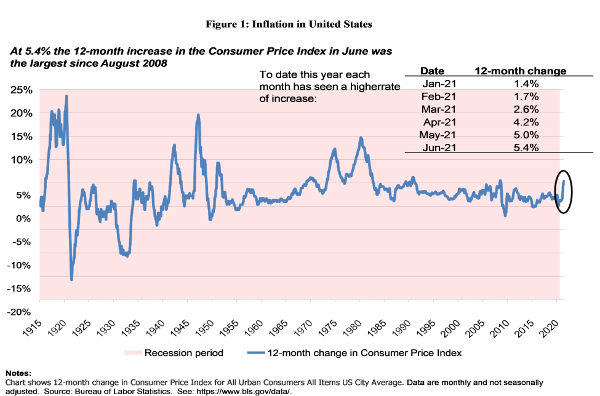

. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. This resulted in a 60 increase. Assume the Federal capital gains tax rate in 2026 becomes 28.

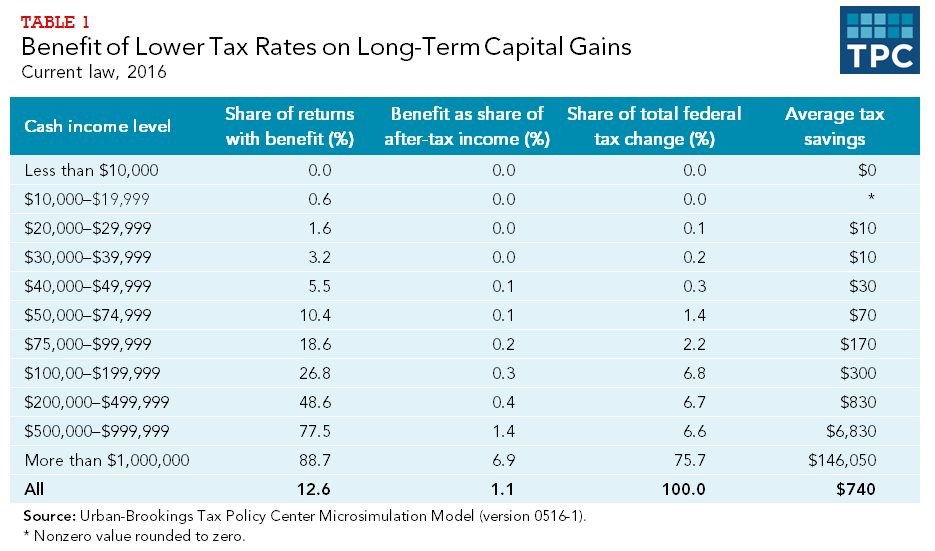

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long. Note that short-term capital gains taxes are even higher.

Currently there are seven different tax rates for individuals the lowest being 10 and the highest falling from 396 to 37. Published 7 days ago. Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. In 1978 Congress eliminated.

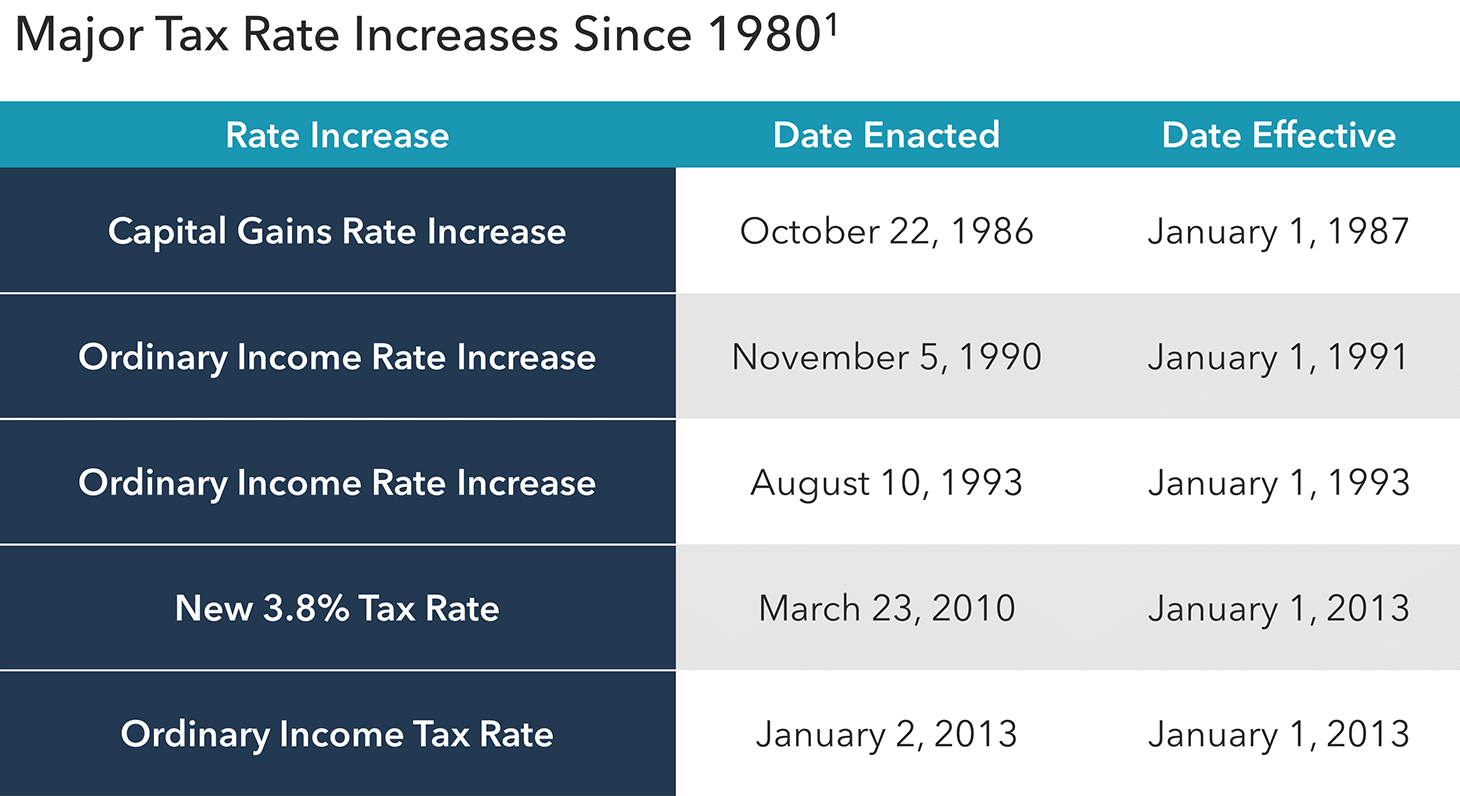

From 1954 to 1967 the maximum capital gains tax rate was 25. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Long-term capital gains come from assets held for over a year. Based on filing status and taxable income long. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The capital gains tax on most net gains is no more than 15 for most people. The effective date for this increase would be September 13 2021.

If we conservatively use. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment.

Capital Gains Tax In The United States Wikipedia

Short Term Capital Gains Tax Rates For 2022 Smartasset

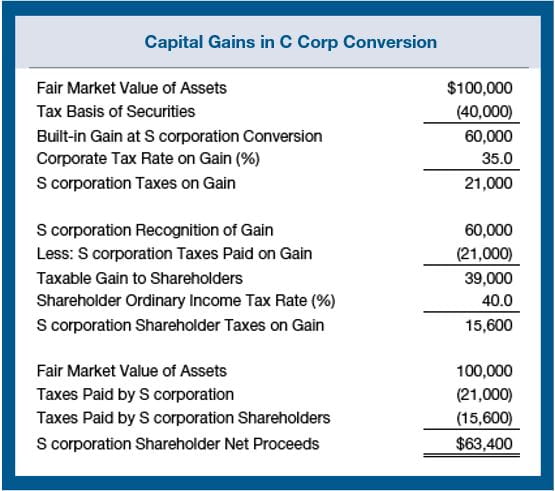

Valuation Impact Of The Built In Gains Tax Liability Stout

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Economic Effects Of Proposed Changes To The Tax Treatment Of Capital Gains

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

Capital Gains Deduction Is An Expensive Loophole Benefiting A Small Number Of Oklahomans Guest Post Cynthia Rogers Ph D Oklahoma Policy Institute

Estimated Income Tax Spreadsheet Mike Sandrik

Capital Gains Tax What Is It When Do You Pay It

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Capital Gains Tax What It Is How It Works And Current Rates

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

House Democrats Propose Hiking Capital Gains Tax To 28 8

Capital Gains Full Report Tax Policy Center

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Benefits Of Qoz Investing Under Biden S Capital Gains Tax Plan Origin Investments